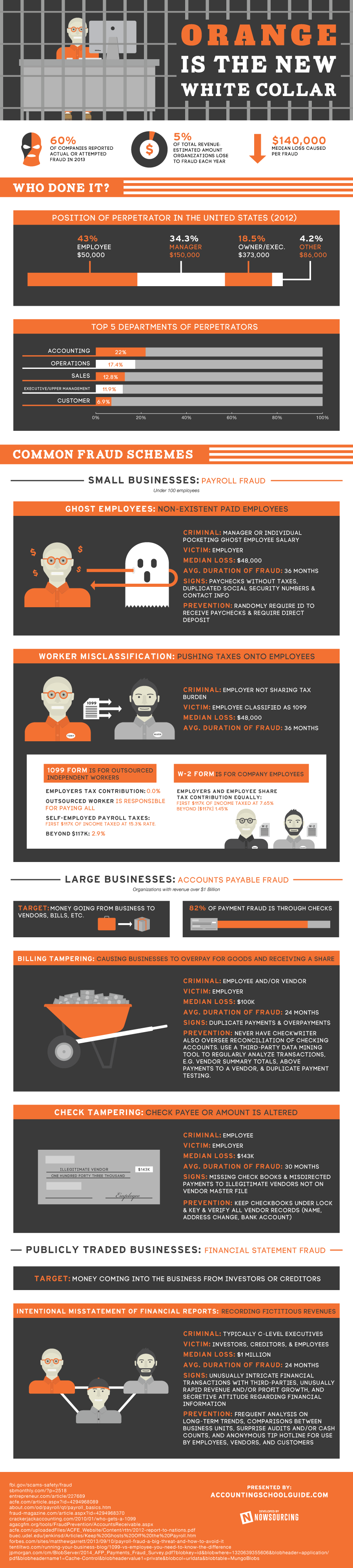

Orange is The New White Collar

- 60% of Companies Reported Actual or Attempted Fraud in 2013

- 5% of total revenues, estimated amount organizations lose to fraud each year

- $140,000 median loss caused per fraud

Who Done It?

Position of Perpetrator in the United States – 753 Cases:

- Employee – 43% ($50,000)

- Manager – 34.3% ($150,000)

- Owner / Executive – 18.5% ($373,000)

- Other – 4.2% ($86,000)

Departments of Perpetrator (in 2012)

- Accounting: 22%

- Operations: 17.4%

- Sales: 12.8%

- Executive/Upper Management: 11.9%

- Customer Service: 6.9%

Common Fraud Schemes

In small businesses

-

- – under 100 employees:

Payroll Fraud

- Target: Money going from business to employees.

- Occurs in 27% of businesses.

- Median Loss: $48,000

- Median duration of fraud: 36 months

- Ghost Employees: Non-existent Paid Employees

- Criminal: Manager or Individual pocketing Ghost Employee salary

- Victim: Employer

- Median Loss: $48,000

- Median duration of fraud: 36 months

- Signs: Paychecks without Taxes

- Duplicated Social Security Numbers & Contact Info.

- Prevention: Randomly require ID to receive paychecks

- Require Direct Deposit

- Worker Misclassification: Pushing taxes onto employees

- Criminal: Employer not sharing tax burden

- Victim: Employee classified as 1090

- Median Loss: $48,000

- Median duration of fraud: 36 months

How does the fraud occur?

- 1099 form is for outsourced independent workers

- Employers tax contribution: 0.0%

- Outsourced worker is responsible for paying all

- Self-Employed Payroll Taxes:

- First $117k of income taxed at 15.3% rate.

- Beyond [$117k] 2.9%.

- W-2 form is for company employees

- Employers and Employee share tax contribution equally:

- First $117k of income taxed at 7.65%

- Beyond [$117k] 1.45%

In Large Businesses:

Accounts Payable Fraud

- Organizations with revenue over $1 Billion

- Target: money going from business to vendors, bills, etc.

- 82% of Payment Fraud is through Checks

- Billing Tampering : causing business to overpay for goods and receiving a share

- Criminal: Employee and/or Vendor

- Victim: Employer

- Median loss: $100k

- Median duration of fraud: 24 months

- Signs: Duplicate Payments, Overpayments

- Prevention: Never have check writer also oversee reconciliation of checking accounts

- Use a third-party data mining tool to regularly analyze transactions

- Vendor Summary Totals

- Above Average Payments To A Vendor

- Duplicate Payment Testing

- Check Tampering : Check payee or amount is altered

- Criminal: Employee

- Victim: Employer

- Median loss: $143k

- Median duration of fraud: 30 months

- Signs: Missing check books

- Misdirected payments to illegitimate vendors not on vendor master file.

- Prevention

- Keep Checkbooks under lock and key

- Verify all vendor records (name, address change, bank account)

In Publicly Traded Businesses:

Financial Statement Fraud:

- Intentional misstatement of financial reports

- Examples: Recording fictitious revenues

- understating reported expenses

- artificially inflating reported assets

- Target: Money coming into the business from investors or creditors

- Criminal: Typically C-Level Executives

- Victim: Investors, creditors, and employees

- Median loss: $1 million (the greatest of all categories)

- Median duration of fraud: 24 months

- Signs: Unusually intricate financial transactions with third-parties

- Unusually rapid revenue and/or profit growth

- Secretive attitude regarding financial information

- Prevention: Frequent analysis on long-term trends comparisons between business units.

- Surprise audits and/or cash counts.

- Anonymous tip hotline for use by employees, vendors and customers.

Sources:

- http://www.entrepreneur.com/article/227689

- http://www.forbes.com/sites/matthewgarrett/2013/09/10/payroll-fraud-a-big-threat-and-how-to-avoid-it

- http://www.buec.udel.edu/jenkinsd/Articles/Keep%20Ghosts%20Off%20the%20Payroll.htm

- http://tentiltwo.com/running-your-business-blog/1099-vs-employee-you-need-to-know-the-difference

- http://www.fbi.gov/scams-safety/fraud

- http://www2.agacgfm.org/tools/FraudPrevention/AccountsPayable.aspx

- http://www2.agacgfm.org/tools/FraudPrevention/AccountsReceivable.aspx

- http://www.crackerjackaccounting.com/2010/01/who-gets-a-1099

- https://www.jpmorgan.com/cm/BlobServer/2014_AFP_Payments_Fraud_Survey.pdf?blobkey=id&blobwhere=1320639355606&blobheader=application/pdf&blobheadername1=Cache-Control&blobheadervalue1=private&blobcol=urldata&blobtable=MungoBlobs

- http://www.sbmonthly.com/?p=2518

- http://www.acfe.com/article.aspx?id=4294968089

- http://taxes.about.com/od/payroll/qt/payroll_basics.htm

- http://www.fraud-magazine.com/article.aspx?id=4294968370

- http://www.acfe.com/uploadedFiles/ACFE_Website/Content/rttn/2012-report-to-nations.pdf