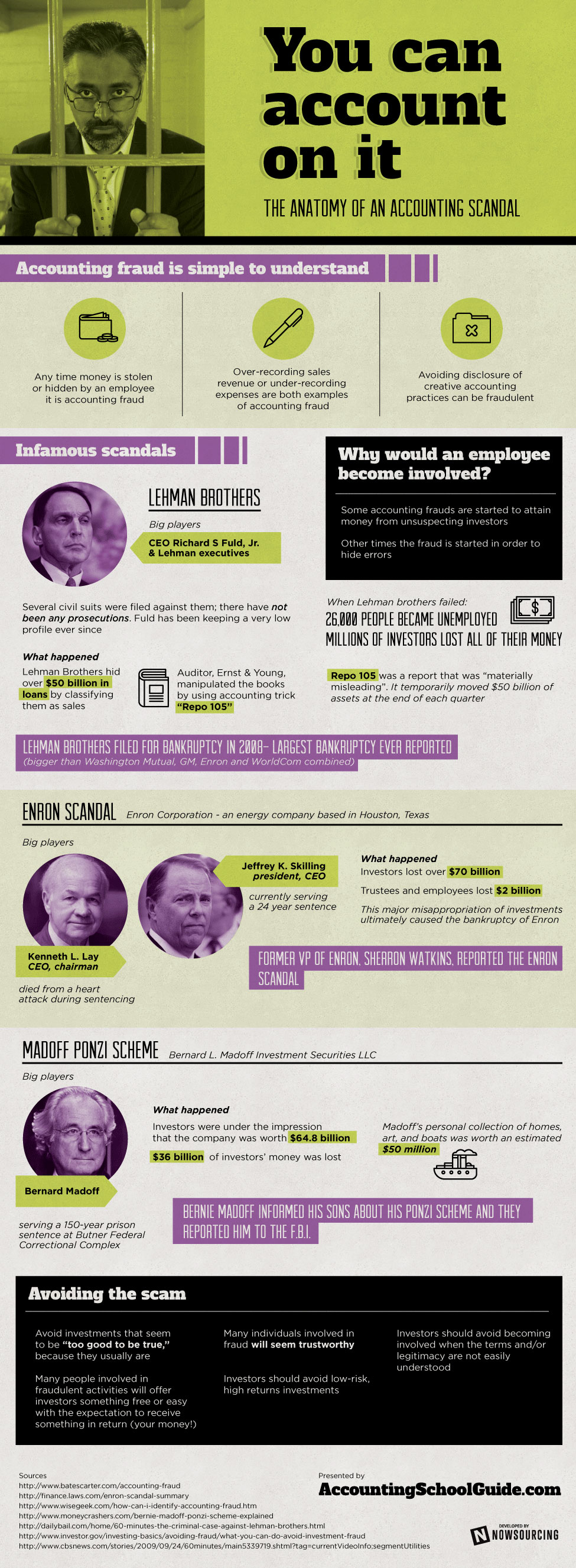

Anatomy of an Accounting Scandal

Accounting fraud is simple to understand

- Anytime money is stolen or hidden by an employee it is accounting fraud

- over-recording sales revenue or under-recording expenses are both examples of accounting fraud

- even avoiding disclosure of creative accounting practices can be fraudulent

Why would an employee become involved

- some accounting frauds are started to attain money from unsuspecting investors

- other times the fraud is started in order to hide errors

Infamous scandals

Lehman Brothers

Big players:

CEO Richard S Fuld, Jr. & Lehman executives

Several civil suits were filed against them; there have not been any prosecutions. Fuld has been keeping a very low profile ever since.

What happened

- Lehman Brothers hid over $50b in loans by classifying them as sales

- Auditor, Ernst & Young, manipulated the books by using accounting trick “Repo 105”

- Repo 105 was a report that was “materially misleading”

- it temporarily moved $50b of assets at the end of each quarter

- This made them appear to be far less dependent on borrowed money than they actually were

When Lehman Brothers failed:

- 26 thousands people became unemployed

- millions of investors lost all of their money

The end of the scam

- Lehman Brothers filed for bankruptcy in 2008

- Largest bankruptcy ever reported (bigger than Washington Mutual, GM, Enron and WorldCom combined)

- The entire global economy was affected by the fall of Lehman Brothers

Enron Scandal

Enron Corporation – an energy company based in Houston, Texas

Big players, where are they now:

Kenneth L. Lay – CEO, chairman, died from a heart attack during sentencing

Jeffrey K. Skilling – president, CEO, currently serving a 24 year sentence

What happened

- investors lost over $70 billion

- trustees and employees lost $2 billion

- this major misappropriation of investments ultimately caused the bankruptcy of Enron

The end of a scam

- Former VP of Enron, Sherron Watkins, reported the Enron scandal

Madoff Ponzi Scheme

Bernard L. Madoff Investment Securities LLC

Big players, where are they now:

Bernard Madoff, serving a 150-year prison sentence at Butner Federal Correctional Complex

What happened

- investors were under the impression that the company was worth $64.8 billion dollars

- $36 billion dollars of investors’ money was lost

- Madoff’s personal collection of homes, art, and boats was worth an estimated $50 million dollars

The end of a scam

- Bernie Madoff informed his sons about his ponzi scheme and they reported him to the F.B.I.

Avoiding the scam

- avoid investments that seem to be “too good to be true,” they usually are

- beware of the halo effect

- many individuals involved in fraud will seem trustworthy

- investors should avoid low-risk, high returns investments

- investors should avoid becoming involved when the terms and/or legitimacy are not easily understood

- many people involved in fraudulent activities will offer investors something free or easy with the expectation to receive something in return (your money!)

Sources

- http://www.batescarter.com/accounting-fraud

- http://www.wisegeek.com/how-can-i-identify-accounting-fraud.htm

- http://finance.laws.com/enron-scandal-summary

- http://www.investor.gov/investing-basics/avoiding-fraud/what-you-can-do-avoid-investment-fraud

- http://dailybail.com/home/60-minutes-the-criminal-case-against-lehman-brothers.html