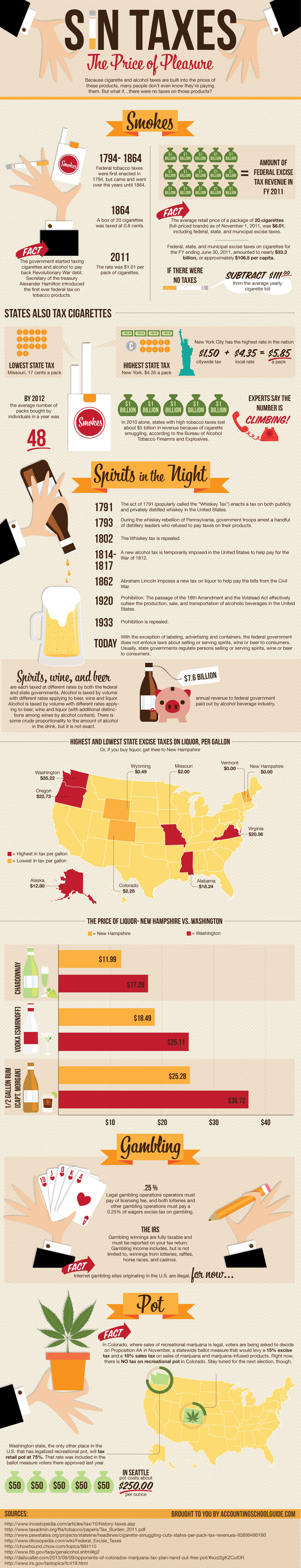

Because cigarette and alcohol taxes are built into the prices of these products, many people don’t even know they’re paying them. But what if…there were no taxes on those products?

Smokes

1794-1864: Federal tobacco taxes were first enacted in 1794, but came and went over the years until 1864.

FACT: The government started taxing cigarettes and alcohol to pay back Revolutionary War debt. Secretary of the treasury Alexander Hamilton introduced the first ever federal tax on tobacco products.

1864: A box of 20 cigarettes was taxed at 0.8 cents.

2011: In 2009, the rate was $1.01 per pack of cigarettes.

$15 billion: Amount of federal excise tax revenue in FY 2011

States also tax cigarettes.

1. Lowest state tax: Missouri taxes are 17 cents a pack

2. Highest state tax: New York, $4.35 a pack

3. New York City has a citywide tax of $1.50, making the combined state and local rate $5.85 a pack, the highest in the nation

FACT: The average retail price of a package of 20 cigarettes (full-priced brands) as of November 1, 2011, was $6.01, including federal, state, and municipal excise taxes.

By 2012, the average number of packs bought by individuals in a year was 48

Federal, state, and municipal excise taxes on cigarettes for the FY ending June 30, 2011, amounted to nearly $33.3 billion, or approximately $106.5 per capita.

IF THERE WERE NO TAXES: Subtract $107 from your total cigarette bill.

WOW: In 2010 alone, states with high tobacco taxes lost about $5 billion in revenue because of cigarette smuggling, according to the Bureau of Alcohol Tobacco Firearms and Explosives. Experts say the number is climbing.

Spirits in the Night

1791: The act of 1791 (popularly called the “Whiskey Tax”) enacts a tax on both publicly and privately distilled whiskey in the United States.

1793: During the whiskey rebellion of Pennsylvania, government troops arrest a handful of distillery leaders who refused to pay taxes on their products.

1802: The Whiskey tax is repealed.

1814-1817: A new alcohol tax is temporarily imposed in the united States to help pay for the War of 1812.

1862: Abraham Lincoln imposes a new tax on liquor to help pay the bills from the Civil War.

1920: Prohibition. The passage of the 18th Amendment and the Volstead Act effectively outlaw the production, sale, and transportation of alcoholic beverages in the United States.

1933: Prohibition is repealed

Today: With the exception of labeling, advertising and containers, the federal government does not enforce laws about selling or serving spirits, wine or beer to consumers. Usually, State governments regulate persons selling or serving spirits, wine or beer to consumers.

Spirits, wine and beer are each taxed at different rates by both the federal and state governments. Alcohol is taxed by volume with different rates applying to beer, wine and liquor (with additional distinctions among wines by alcohol content). There is some crude proportionality to the amount of alcohol in the drink, but it is not exact.

$7.6 billion: annual revenue to federal government paid out by alcohol beverage industry.

Highest and lowest state excise taxes on liquor, per gallon: Or, if you buy liquor, get thee to New Hampshire.

Highest:

Washington – $26.70

Oregon – $23.03

Virginia – $20.91

Alabama – $18.61

Michigan – $13.24

Lowest:

New Hampshire – $0

Vermont – $.32

Wyoming – $.83

Montana – $2.00

Colorado – $2.28

Gambling

.25 percent: Legal gambling operations operators must pay of licensing fee, and both lotteries and other gambling operations must pay a 0.25% of wagers excise tax on gambling.

The IRS: Gambling winnings are fully taxable and must be reported on your tax return. Gambling income includes, but is not limited to, winnings from lotteries, raffles, horse races, and casinos.

Internet gambling sites originating in the U.S. is illegal. FOR NOW.

Pot

FACT: In Colorado, where sales of recreational marijuana is legal, voters are being asked to decide on Proposition AA in November, a statewide ballot measure that would levy a 15 percent excise tax and a 10 percent sales tax on sales of marijuana and marijuana-infused products.

Sources:

- http://www.investopedia.com/articles/tax/10/history-taxes.asp

- http://www.taxadmin.org/fta/tobacco/papers/Tax_Burden_2011.pdf

- http://www.pewstates.org/projects/stateline/headlines/cigarette-smuggling-cuts-states-per-pack-tax-revenues-85899480180

- http://chowhound.chow.com/topics/884115

- https://www.ttb.gov/

- http://dailycaller.com/2013/09/09/opponents-of-colorados-marijuana-tax-plan-hand-out-free-pot/#ixzz2gKZCuIDR

- http://www.irs.gov/taxtopics/tc419.html