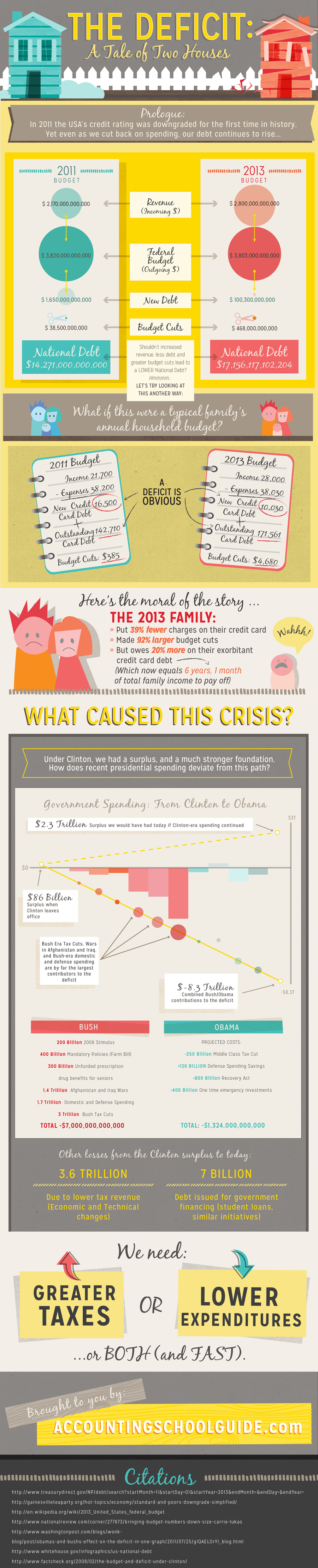

The Deficit: A Tale of Two Houses

In 2011, for the first time in history, our credit rating was downgraded

Our budget looked like this:[2]

2011: (When our credit rating was downgraded)

U.S. Tax revenue: $2,170,000,000,000

Federal budget: $3,820,000,000,000

New debt: $ 1,650,000,000,000

National debt: $14,271,000,000,000

Recent [April] budget cut: $ 38,500,000,000

Too many zeros?

What if this were a single family’s budget?

Subtract 8 zeroes:

Annual family income: $21,700

Money the family spent: $38,200

New debt on the credit card: $16,500

Outstanding balance on the credit card: $142,710

Budget cuts: $385

So…

The family spent 76% more than they had with a credit card

Bringing the credit card balance to 657% of family income

But the family did cut back spending by roughly 1%…

The first house fell, what about today’s?

2013:

Total Direct revenue: $2,800,000,000,000

Federal Budget: $3,803,000,000,000

New Debt: $100,300,000,000

National Debt:$17,156,117,102,204

Savings relative to last year: $468,000,000,000

Too many zeros?

What if this were a single family’s budget?

Subtract 8 zeroes…

Annual Family Income: $28,000

Money the Family Spent: $38,030

New Debt on Credit Card: $10,030

Outstanding Credit Card Debt: $171,561

Budget Cuts:$4,680

The 2013 family makes 29% more than the 2011 family

Put 39% less new charges on their credit card

Made 92% larger budget cuts

But owes 20% more on their exorbitant credit card debt.

Which now equals 6 years, 1 month of total family income to pay off.

A deficit is obvious.

Our debt has increased in tandem with our debt cutting.

What caused this crisis?

From Clinton’s surplus to today:

-$3,600,000,000,000 Economic and Technical Changes (lower tax revenue)

-$700,000,000,000 Debt issued for government financing (student loans, similar initiatives)

(2001-2008) Bush Era Components[5][6]

-$400,000,000,000 Mandatory Policies (Farm Bill)

-$1,400,000,000,000 Afghanistan and Iraq Wars

-$1,700,000,000,000 Domestic and Defense Spending

-$200,000,000,000 2008 Stimulus

-$300,000,000,000 Unfunded prescription drug benefits for seniors

-$3,000,000,000,000 Bush Tax Cuts

Total -$7,000,000,000,000

(2009-2017) (Projected costs)Obama Era Components

-$400,000,000,000 One time emergency investments

-$250,000,000,000 Middle Class Tax Cut

-$800,000,000,000 Recovery Act

+$126,000,000,000 Defense Spending Savings

Total: $1,324,000,000,000

Bush Era Tax Cuts, Wars in Afghanistan and Iraq, and Bush-era domestic and defense spending are by far the largest contributors to the deficit.

If Clinton’s policies had continued

2011: +$2,300,000,000,000 Surplus

We need greater taxes, or lower expenditures, or both. And Fast.

Citations:

- http://en.wikipedia.org/wiki/2013_United_States_federal_budget

- http://www.nationalreview.com/corner/277873/bringing-budget-numbers-down-size-carrie-lukas

- http://www.washingtonpost.com/blogs/wonkblog/post/obamas-and-bushs-effect-on-the-deficit-in-one-graph/2011/07/25/gIQAELOrYI_blog.html

- http://www.whitehouse.gov/infographics/us-national-debt