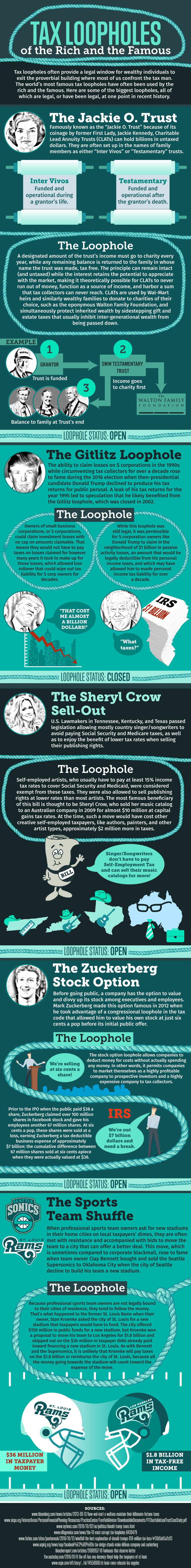

Tax Loopholes of the Rich and the Famous

Tax loopholes often provide a legal window for wealthy individuals to exit the proverbial building where most of us confront the tax man. The world’s most famous tax loopholes have often been used by the rich and the famous. Here are some of the biggest loopholes, all of which are legal, or have been legal, at one point in recent history.

The Jackie O. Trust

Famously known as the “Jackie O. Trust” because of its coinage by former First Lady, Jackie Kennedy, Charitable Lead Annuity Trusts (CLATs) can hold billions in untaxed dollars. They are often set up in the names of family members as either “Inter Vivos” or “Testamentary” trusts.

The Loophole

A designated amount of the trust’s income must go to charity every year, while any remaining balance is returned to the family in whose name the trust was made, tax free. The principle can remain intact (and untaxed) while the interest retains the potential to appreciate with the market, making it theoretically possible for CLATs to never run out of money, function as a source of income, and harbor a sum that tax collectors can never reach. CLATs are used by Wal-Mart heirs and similarly wealthy families to donate to charities of their choice, such as the eponymous Walton Family Foundation, and simultaneously protect inherited wealth by sidestepping gift and estate taxes that usually inhibit inter-generational wealth from being passed down.

Loophole Status: Open

The Gitlitz Loophole

The ability to claim losses on S corporations in the 1990s while circumventing tax collectors for over a decade rose to fame during the 2016 election when then-presidential candidate Donald Trump declined to produce his tax returns for public perusal. A leak of his tax returns for the year 1995 led to speculation that he likely benefited from the Gitlitz loophole, which was closed in 2002.

The Loophole

Loophole Status: Closed

The Sheryl Crow Sell-Out

U.S. Lawmakers in Tennessee, Kentucky, and Texas passed legislation allowing mostly country singer/songwriters to avoid paying Social Security and Medicare taxes, as well as to enjoy the benefit of lower tax rates when selling their publishing rights.

The Loophole

Self-employed artists, who usually have to pay at least 15% income tax rates to cover Social Security and Medicaid, were considered exempt from these taxes. They were also allowed to sell publishing rights at lower rates than most artists. The most famous beneficiary of this bill is thought to be Sheryl Crow, who sold her music catalog to an Australian company in 2009 for almost $10 million at capital gains tax rates. At the time, such a move would have cost other creative self-employed taxpayers, like authors, painters, and other artist types, approximately $2 million more in taxes.

Loophole Status: Open

The Zuckerberg Stock Option

Before going public, a company has the option to value and divvy up its stock among executives and employees. Mark Zuckerberg made this option famous in 2012 when he took advantage of a congressional loophole in the tax code that allowed him to value his own stock at just six cents a pop before its initial public offer.

The Loophole

Loophole Status: Open

The Sports Team Shuffle

When professional sports team owners ask for new stadiums in their home cities on local taxpayers’ dimes, they are often met with resistance and accompanied with bids to move the team to a city that can offer a better deal. This move, which is sometimes compared to corporate blackmail, rose to fame when team owner Clay Bennett bought and sold the Seattle Supersonics to Oklahoma City when the city of Seattle decline to build his team a new stadium.

[COMMENT=LARGE, NET-SHAPED ROPE inside of which the following text appears.=ENDCOMMENT]

The Loophole

Because professional sports team owners are not legally bound to their cities of residence, they tend to follow the money. That’s what happened to the former St. Louis Rams when their owner, Stan Kroenke asked the city of St. Louis for a new stadium that taxpayers would have to fund. The city offered $150 million in public funds for a new stadium, but Kroenke won a proposal to move his team to Los Angeles for $1.8 billion and skipped out on the $36 million in taxpayer debt already paid toward financing a new stadium in St. Louis. As with Bennett and the Supersonics, it is unlikely that Kroenke will pay taxes on the $1.8 billion or reimburse the city of St. Louis, because all the money going towards the stadium will count toward the expense of the move.

Loophole Status: Open

Sources:

https://www.bloomberg.com/news/articles/2013-09-12/how-wal-mart-s-waltons-maintain-their-billionaire-fortune-taxes

https://www.aicpa.org/InterestAreas/PersonalFinancialPlanning/Resources/PracticeCenter/ForefieldAdvisor/DownloadableDocuments/FFCharitableLeadTrustCaseStudy.pdf

http://www.villagevoice.com/news/the-10-most-corrupt-tax-loopholes-6436479

http://www.forbes.com/sites/janetnovack/2016/10/12/windfall-the-best-explanation-of-donald-trumps-916-million-tax-loss/#30d5dd5a2c93

http://www.uspirg.org/news/usp/facebook%E2%80%99s-tax-dodge-stands-make-billions-company-and-zuckerberg

http://bleacherreport.com/articles/2688952-10-fanbases-that-deserve-better

If the NFL has any decency, they'll help the taxpayers of St. Louis

http://www.espn.com/nfl/story/_/id/14558668/st-louis-rams-relocate-los-angeles